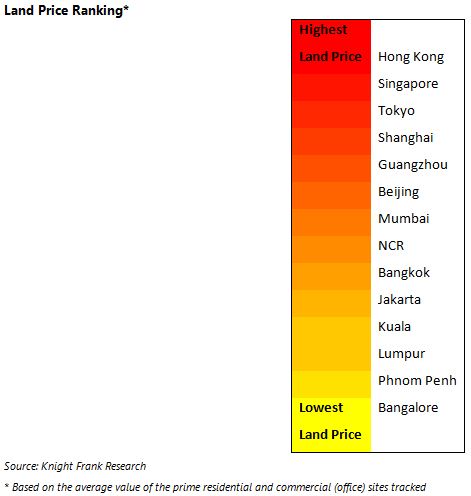

Knight Frank has published its first-ever Prime Asia Development Land Index which derives the price of prime residential (apartment or condominium) and commercial (office) development land in 13 major cities across Asia, for the period December 2011 to December 2013.

The land prices in the Index are derived using a repeat residual valuation methodology where Knight Frank essentially looks at what a reasonable developer would be expected to pay for development land, given the gross development value of the potential scheme, costs (construction, professional, contingencies, and financial), required profit, acquisition costs and relevant taxes.

“As the first-ever Index on development land prices of its size and scope, this will become an important resource for developers, investors, financers and policy makers,” says Nicholas Holt, Head of Research for Asia Pacific. “A key observation from our findings points to the fact that in developing Asia we are seeing low liquidity and rapid land price appreciation, whilst in developed Asia such as Hong Kong, Singapore and Tokyo, we see the highest land prices and redevelopment opportunities. In these mature markets, the lack of prime development land has led to more emphasis on redevelopment opportunities, while given the higher cost of land and in some cases high holding taxes, there is often more pressure to develop quickly.”

Key highlights of the Prime Asia Development Land Index

• The results show that in the two years from December 2011, 24 of the 26 markets tracked (13 residential and 13 offices) saw an increase in their indices reflecting increasing prime land prices amid tight supply and strong demand.

• Southeast Asian markets see the fastest price growth for prime development land: Bangkok, Jakarta, Kuala Lumpur and Phnom Penh make up 4 of top 5 cities in terms of price growth.

• The mature markets of Hong Kong, Singapore and Tokyo saw the lowest price growth.

• Prime Asia residential and office development land indices increased 50.4% and 38.3% respectively over the last two years.

• With competition for prime development sites remaining as strong as ever, increasing numbers of developers and investors are looking overseas for opportunities. Evident from a 55% year-on-year increase in intra-Asian cross-border developments driving price growth in development land.

Analysis of the China market

• China remains the most active market, with Tier 1 cities seeing significant land price appreciation over the last two years.

• Within China, Beijing emerged as one of the markets with the strongest price growth with an increase of 37.0% and 53.1% respectively in the prime residential and office development land over the last two years. Guangzhou followed with 30.8% and 28.7% increase in the prime residential and office indices respectively, whilst Shanghai saw a 20.0% and 19.4% increase respectively.

• The creation of wealth and the growth in number of High-Net-Worth Individuals have largely fuelled the rise in these prime residential markets in China’s Tier 1 cities.

• Land development in China has dwarfed development markets anywhere else in the world with its unprecedented conversion of agricultural land to urban land over the last two decades.

Analysis of the Hong Kong market

• As of November 2013, the government had received 116 applications for the revitalisation of industrial buildings, of which 100 applications were for wholesale conversion and 16 were for redevelopment. 86 applications have been approved.

• Due to the continual implementation of various property market cooling policies, office and residential prices could go down slightly in 2014. Thomas Lam, Director and Head of Research & Consultancy, Greater China at Knight Frank expects land prices to experience further dips in the coming year.

Intra-Asian Development Activity on the increase

The lack of prime income producing assets on the market has led to many investors increasingly looking at taking on development risk, not just in their home markets, but also offshore. While the western markets of Australia, UK and US have been the recipients of significant amounts of Asian developer’s capital, intra-Asian capital flows are also on the increase.

Nicholas Holt adds, “The opportunity to partner with an experienced foreign developer to benefit from the co-branding and to tap into the overseas expertise are some of the key motivating factors contributing to the increase in cross-border developments. We expect this movement of developers going offshore into joint ventures to increase, not only due to the factors mentioned, but also due to push factors in local markets largely driven by the impacts of the numerous rounds of cooling measures introduced, most notably into the Chinese, Singaporean, Hong Kong and Malaysian residential markets.”