Knight Frank has published a report titled “Chinese Outward Investment, After the Initial Waves, What’s Next?”. There has been tremendous surge of Chinese outward investment in overseas real estate in recent years. From 2009 to 2014, the total value of Chinese overseas investment volume has skyrocketed from US$0.6 billion to hit an estimated US$15 billion. So far the thrust of this investment has been focused in gateway cities of Australia, the US and the UK. In 2014, Australia has seen the strongest growth in inbound real estate investment from China at over 60% increase year on year.

Chinese outward real estate investment into foreign gateway cities

Source: Knight Frank Research

Neil Brookes, Head of Capital Markets for Asia Pacific at Knight Frank, says, “Investors today are shifting their focus towards sustainable returns in the long term. The key factors for Chinese investors are the policy push from the Chinese government to diversify into other countries; a softening domestic market; and the pull from higher returns achievable in overseas markets.

“Australia, the US and the UK are the top three markets most Chinese investors are looking at. We saw five times as much capital outflow from China into these three markets in 2013 alone compared to the previous year. We expect the transaction volumes from Chinese investors into these three markets this year will match or even exceed that of last year.”

In this report, Knight Frank investigates the key drivers and new development for these Chinese outward real estate investments, with the following key findings:

• The softening of Chinese market conditions (with its low yield, lack of investable stock and depressed residential markets) continue to impact Chinese investors and developers. With Government policy encouraging firms to expand overseas, we continue to see active investment activities by Chinese institutional investors, banks and developers. However, due to the policy-driven nature of the Chinese market, there remains a risk that China’s outward investment could be impacted by policy adjustments.

• The first wave of Chinese capital outflow saw sovereign wealth funds investing in trophy assets and banks acquiring property for owner occupation. Large developers followed, looking to diversify with an overseas presence. In this current third wave equity investors and insurance firms are seeking core and yield-driven opportunities. We are now seeing the formation of fourth wave of investors who are harder to predict and track. These investors consists of ultra-high net worth Individuals (UHNWIs), small to mid-cap state-owned enterprises (SOEs) and private developers who are increasingly evaluating their overseas strategy and exploring overseas growth.

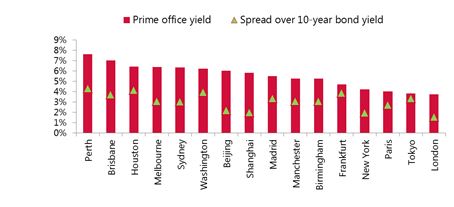

David Ji, Director, Head of Research & Consultancy of Greater China at Knight Frank, highlights, “Many provincial capitals and key cities Australia, the US and the UK have now presented a better yield spread (i.e. the gap between yield return from property investment over bond returns) than gateway cities of London, New York, Sydney and Melbourne.”

Attractiveness of investment - Prime office yield and spread over 10-year bond yield

Source: Knight Frank Research

“From our knowledge on overseas investment activities, only 4 out of the top 20 Chinese insurance companies have made significant offshores investment, while 40% of them are considering overseas expansion. Chinese developers are more aggressive with half of the top 20 player have already made offshores investment. If we look into small to mid-cap investors, the potential pool of investment will be significant”, says David Ji.

Having invested heavily in gateway cities, Chinese investors are diversifying by moving from core office and residential development into leisure to industrial assets. Investors are also looking to diversify geographically moving from gateway locations into higher yielding leading provincial capitals.

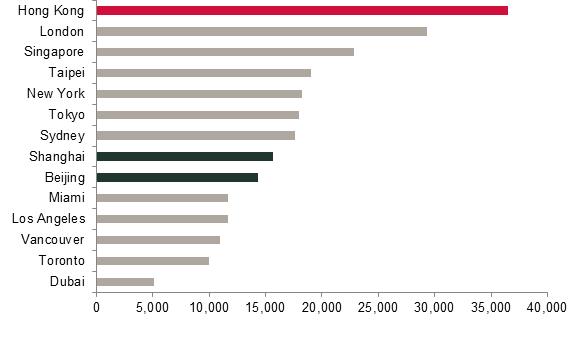

Thomas Lam, Senior Director, Head of Valuation & Consultancy at Knight Frank adds, “Whilst the Chinese HNWIs investors become more mature, many of them begin to explore new investment opportunities hot spots around the globe, such as Johor Bahru in Malaysia, Gold Coast in Australia, Los Angeles and Miami in the US. All these hot spots presented investors with higher yield than traditional overseas investment locations like London, New York or Sydney.

“Comparing with key Chinese gateway cities such as Beijing and Shanghai, a number of recent investment hot spots have shown a discount in prime residential prices. For example, Los Angeles and Miami prime apartment prices are both about 25% lower than Shanghai, drawing significant interest from HNWIs in China.”

Top ten most expensive investment destinations for Chinese HNWIs

Source: Knight Frank Research

Prime apartment prices in selected overseas markets

Source: Knight Frank Research

Recent overseas investment hot spots for Chinese HNWIs

Source: Knight Frank Research