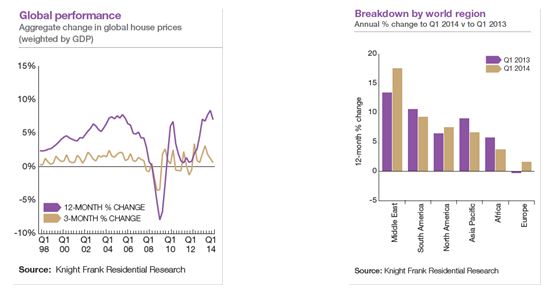

According to the latest Knight Frank Global House Price Index for Q1 2014, the Index has risen for eight consecutive quarters but the rate of price growth slowed in the first three months of 2014. For the first time since 2008, no single country tracked by the Index has recorded an annual price fall in excess of 10%. 11 of the 54 countries on the Index are from Asia Pacific.

Results for Q1 2014:

• The Knight Frank Global House Price Index rose by 0.6% in the first quarter of 2014, down from 1.2% in the previous quarter.

• Dubai topped the annual rankings, but prices rose by only 3.4% in the first quarter, compared to a 9.2% jump over the same period in 2013.

• Croatia, Cyprus and Greece were the weakest-performing housing markets in the 12 months to March 2014.

• The US, Australia and Iceland now sit alongside several emerging markets in the top ten rankings for annual price growth.

• Fourteen countries recorded a decline in house prices year-on-year, 12 of these are in Europe whilst Singapore and Japan are the only two non-European countries.

Nicholas Holt, Head of Research for Asia Pacific at Knight Frank, says, “Cooling measures and tighter mortgage lending conditions have halted price growth in Singapore, whilst in Japan “abenomics” has yet to push house price growth into positive territory. We expect to see the index’s performance strengthen again in the second quarter. All eyes will remain on central banks, in particular the Federal Reserve, the Bank of England and the European Central Bank. The issue is not when interest rates rise but the speed and extent to which they do.”

David Ji, Head of Research & Consultancy, Greater China at Knight Frank says, “In Mainland China, the government’s housing control policies have taken a toll on house price growth nationwide. We have observed a steady slowdown in house price growth as domestic credit control and development restrictions have forced some developers to offer their units in more preferential terms.”