The cooling measures have changed the contribution of primary and secondary sales to total residential sales in Hong Kong, with the proportion of primary sales rose in 2013 and 2014, the trend is expected to continue in 2015. In Mainland China, residential prices are expected to stabilise due to policy relaxation and interest-rate cut.

At a press conference held in Knight Frank’s Hong Kong office this afternoon, Thomas Lam, Senior Director, Head of Valuation & Consultancy, Knight Frank, David Ji, Director, Head of Research & Consultancy, Greater China, Knight Frank, together with Helen Liu, General Manager, Beijing Holdways Information & Technology Co., Ltd, present their forecasts for Hong Kong and Mainland China’s property markets in 2015.

Mainland China residential property market:

• Many Chinese cities have relaxed purchase restrictions and the Central Bank has lowered interest rates to boost the Mainland property market, same as the downturns in the past.

• However, this time the boosting effect is expected to be incomparable with past downturns because of changing consumption pattern. Although Chinese are still fond of buying properties, they are now eyeing and lured by increasing opportunities to buy overseas.

• Helen Liu, General Manager, Beijing Holdways Information & Technology Co., Ltd expects that with better urban planning and infrastructure development, demand and supply mechanism in the Mainland residential property market will improve in the long run. The “ghost city” problem is set to be relieved with prudent land supply policy; although in the short term this could slow down land development and lower income of local governments.

• Looking ahead, David Ji, Director, Head of Research & Consultancy, Greater China at Knight Frank does not expect residential prices in China to increase significantly due to the policy relaxation and interest-rate cut, but stabilise, with mild growth in first-tier cities and downward pressure in some second and third-tier cities.

Hong Kong residential property market:

• According to Knight Frank, Hong Kong’s average prime residential price ranked 2nd globally in 2013, following Monaco in the first place.

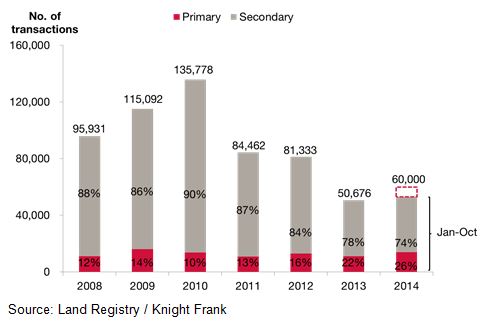

• With continued cooling measures in Hong Kong, residential sales volume plunged from over 100,000 per year before 2010 to only about half in recent years. Home sales over 2014 are expected to reach 60,000-65,000, representing a 20-30% rebound from the whole of 2013.

• The cooling measures have also changed the contribution of primary and secondary sales to total residential sales. In 2013 and 2014, the proportion of primary sales rose to over 20% of total sales, while they only contributed over 10% in the previous years. The trend is expected to continue in 2015 with the active launch of primary flats by developers at competitive prices.

Proportion of primary and secondary residential sales in Hong Kong

• With prices having surged in previous years, residential sales in the past year focused on the HK$3-5 million and HK$5-10 million unit price segments, all together taking up 67% of the total sales.

• In terms of the size of transacted units, 90% of units sold in the past year were sized below 1,000 sq ft and 61% below 500 sq ft, due to the surge in home prices and lower affordability of purchasers.

• Affordability ratio in Hong Kong is now at around 60%. If mortgage rate is lifted by 200 bps, the ratio will rise to over 70% and by 300 bps, the ratio will rise to over 80%. Therefore, we estimate that a mortgage-rate rise of less than 300 bps will not bring significant impact on Hong Kong’s residential market.

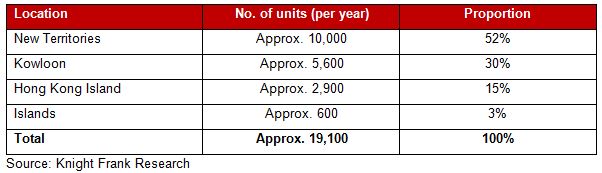

• Looking ahead, future residential supply will focus on the New Territories, followed by Kowloon, while Hong Kong Island will have limited supply. In the New Territories, supply will focus on Yuen Long and Tseung Kwan O, while in Kowloon, supply will concentrate in Kai Tak.

Distribution of future residential supply in Hong Kong (2015-2019)

• Luxury and mass residential prices are expected to follow a different pattern next year. Thomas Lam, Senior Director, Head of Valuation & Consultancy at Knight Frank says “with the implementation of Double Stamp Duty, prices in the luxury residential market have experienced mild downward pressure this year and are expected to drop modestly by less than 5% in 2015, while mass residential prices could remain stable given strong demand for small and medium-sized flats.”