With relaxed Double Stamp Duty in Hong Kong, residential transaction volume is expected to rebound in the remainder of 2014, however, prices are not expected to go up with other cooling measures firmly in place. In Mainland China, growth in home prices is expected to be suppressed in urban areas, while sub-urban districts are expected to see negative price growth.

At a press conference held in Knight Frank’s Hong Kong office this afternoon, Thomas Lam, Senior Director and Head of Valuation & Consultancy, together with David Ji, Director and Head of Research & Consultancy, Greater China, review the Hong Kong and Mainland property markets in the first half of 2014 and present their forecasts in the second half.

Mainland China residential market

• Mainland China residential market is experiencing a polarisation: residential prices in first-tier cities and urban areas remain resilient due to limited supply and strong rigid demand, while suburban areas and lower-tier cities see developers cut prices due to abundant supply and high inventory levels.

• David Ji says the government’s housing control policies have taken a toll on house price growth nationwide. Price growth in the first half of 2014 slowed to a mere 2-3% in first-tier cities and 1-2% in second-tier cities. During the first four months of 2014, housing sales value also saw a year-on-year 10% nationwide drop.

• The central bank's targeted reductions in banks' reserve requirement ratios by half a percentage point is not expected to revive the property sector as its aim is to channel credit to the rural sector and small firms. Some extra money might flow into the real estate market, but not enough to make a difference.

• Although Mainland China’s housing starts decreased 25% year-on-year during the first four months of 2014 due to developers’ lack of capital and high inventory levels: 10-20 months are needed for 16 selected Chinese cities to clear the existing inventory, assuming the average sales volume in 2013 continues and no new supply is added. Developers, facing high debt ratios amid credit tightening, are expected to offer more aggressive price cuts, especially in lower-tier cities and suburban areas, to meet sales target, clear inventory and raise cash in the second half of 2014.

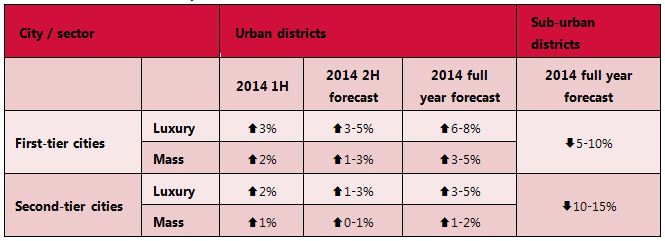

• David Ji expects home prices in urban areas to remain resilient in the second half of 2014, but growth is set to be suppressed to within 5% in first-tier cities and within 3% in second-tier cities. Over 2014, urban mass residential prices are expected to rise only 3-5% in first-tier cities and 1-2% in second-tier cities. Luxury housing prices will perform slightly better. In sub-urban areas, where aggressive price cuts are seen in recent months, overall home prices are forecast to decrease 5-10% in first-tier cities and 10-15% in second-tier cities over 2014.

Mainland China residential prices

Hong Kong residential market

• During February and March 2014, residential sales volumes were low at just over 3,000 transactions per month, but the figures rebounded to 4,781 in April and further rose to 5,270 in May. Thomas Lam expects the relaxation of Double Stamp Duty (DSD) to boost buying sentiment and particularly benefit developers aiming at buyers moving up the property ladder. Transaction volume is expected to increase in the coming months with the release of purchasing power accumulated during the first half of the year. Compared with 50,676 last year, residential transaction volume is expected to remain at around 50,000 this year, a level even lower than the SARS-affected 2003.

• The 2014 sales market will see an active primary sales market, with beneficiary packages offered offsetting some impact of the cooling measures, while secondary sales will also revive with more owners becoming willing to offer discounts to compete with primary units offered at competitive prices.

• The 2014 home sales market will continue to be dominated by end-users, but investors will start to return to the market. The proportion of Chinese buyers in primary projects is expected to grow slightly from 2013, but is still expected to be below 20%, compared with the peak level of around 30-40% in previous years, while the proportion of corporate buyers is set to remain low at below 5%, compared with the peak level of up to 15% in previous years.

• Thomas does not expect the DSD relaxation to raise home prices because of other cooling measures still firmly in place. The market has turned and entered a downtrend. Residential prices will be heading south in the coming few years, but significant corrections are not expected amid a low mortgage rate environment. The only uncertainty will be from the US—the tapering of QE3 and interest-rate rise—but this is not expected until after end of 2015.

• Thomas is seeing a polarised residential market in Hong Kong, with prices on Hong Kong Island remaining firm and those in the New Territories witnessing significant drops. Therefore, overall residential prices only dipped slightly in the first half of 2014. The second half of the year will see more notable drops. Home prices are expected to drop 5% over 2014, due to cooling measures and increased supply.

• Supply in 2014 will focus on the New Territories, in particularly Tai Po and Tseung Kwan O. In the second half of 2014, around 14,600 new homes could become available for sale in Hong Kong.

Hong Kong residential prices

Hong Kong retail market

• Although the number of Mainland visitor arrivals have been increasing, retail sales are dropping in Hong Kong, with luxury goods witnessing significant drops. This reflects the diminished purchasing power and a shift in the consumption pattern of Mainland visitors.

• Mainland China's anti-corruption campaign is gathering pace, while economic growth in Mainland China has slowed down. Many countries, such as South Korea, Singapore and Taiwan, are proactively attracting Mainland visitors. Hong Kong’s attractiveness to Mainland visitors are declining, while local consumption growth has been weak. Retail sales volume is forecast to increase only 5-7% over 2014.

• With shrinking demand for retail space, retail property rents have peaked and are expected to drop. Retailers in Hong Kong, however, are expected to continue suffering from high rents for some more time. Retail property rents have started to face downward pressure and are set to drop around 0-5% in 2014, while retail property prices are also expected to drop around 0-5% in 2014.

Hong Kong prime street shop rental and price forecasts

Hong Kong and Mainland Property Markets Review and Forecast