Knight Frank today launches its inaugural Global Cities 2015 Report. The Global Cities Report assesses the impact on the office markets of more than 1.1 billion city dwellers forecast* over the next 15 years. The increased in urban living in the world’s top cities will see prime office rents reach record highs by the end of the decade according to the new research from Knight Frank.

Highlights:

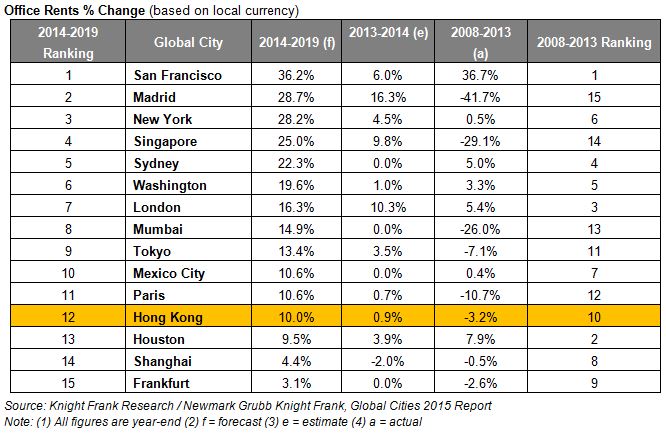

• According to Knight Frank Global Cities Index, Hong Kong ranked second bottom in Asia Pacific in the 2014-2019 office prime rent forecast.

• As of the year end of 2014, Hong Kong is expected to have the lowest office vacancy rate in the world. Tokyo and London are set to overtake Hong Kong by 2019.

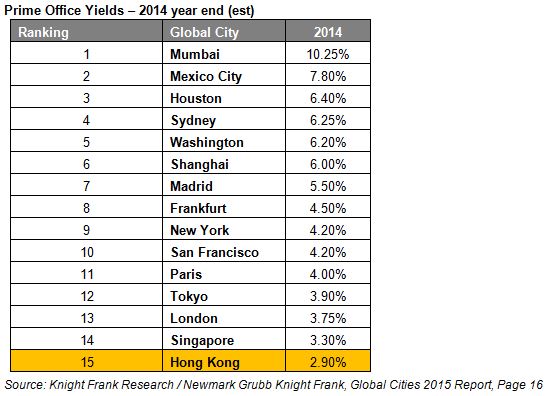

• In 2014, Hong Kong has the lowest prime office yields in the world.

• Hong Kong skyscrapers remain the most expensive in the world.

• Technology and IT sectors have been the key drivers of the take-up of office space in Asia Pacific.

• Chinese insurers who are now allowed to invest up to 30% of their assets in real estate are expected to become more important purchasers in global cities over the coming years.

• Foreign buyers have accounted for the majority of investment volume in London for seven of the last 10 years.

• Hong Kong-Shanghai stock connection allows equity trades between the two Chinese financial hubs to increase inter-connectivity of Asia.

Knight Frank Global Cities Index

The Knight Frank Global Cities Index, tracking the prime office rents in 15 Global Cities, saw an average growth of 19.9% over the next five years. The Index is forecast to rise above its pre-GFC peak sometime in mid-2015.

Over the last five years, to the end of 2013, eight out of the 15 Global Cities registered negative growth in office rents; five of these cities were in Asia, including Hong Kong. Hong Kong is expected to drop 2 places to take the 12th position in the 2014-2019 (year-end) rent forecast (Second bottom for Asia Pacific).

* Source: The United Nations World Urbanisation Prospects, 2011

With limited supply of new offices, as of the year end of 2014, Hong Kong is expected to have the lowest vacant office space among the 15 top cities in the world. Tokyo and London will overtake Hong Kong in 2019 having the lowest office vacancy rate.

We have been witnessing the flurry of real estate investment activity by mainland financial institutions in Hong Kong. Chinese financial institutions’ aggressive expansion is driven by a number of factors, “These acquisitions help brand building while allowing the institution to manage their future occupation costs,” says Paul Hart, Executive Director, Greater China at Knight Frank.

Meanwhile, landlords in Kowloon East continued to face intensive competition for tenants, says Thomas Lam, Senior Director and Head of Valuation & Consultancy, Knight Frank. With relocation costs rising and the gap in rents between the two sides of Victoria Harbour narrowing, tenants are opting to renew leases rather than relocate. After having dipped in previous months, Grade-A office rents in Kowloon East are expected to stabilise during the remainder of the year.

According to Knight Frank Research, Hong Kong has the lowest prime yields among the 15 top cities in the world as office property prices had surged in previous years.

David Ji, Director and Head of Research & Consultancy, Greater China at Knight Frank, says the office sales market continued to revive, as a number of tenants opted to buy their own premises to save on rent costs in the long run. Meanwhile, investors continued to be active in their search for quality premises. For example, an Asian real estate fund management company acquired six mid floors totalling about 156,000 sq ft in Kowloon Commerce Centre in Kwai Chung for about HK$1.4 billion last month.

Thomas adds that government cooling measures introduced on the Hong Kong residential market have channeled some investors’ attention to non-residential properties like offices. Compared to other non-residential properties, subdivided strata-titled offices typically involve lower entry costs and more stable rental yields.

The Skyscraper Index

Source: Knight Frank Global Cities 2015 Report, Pages 19 and 20

Hong Kong office towers remain the most expensive commercial real estate in the world

Capital values of Hong Kong skyscrapers have hit US$6,330 per sq ft, sitting 50% higher than Tokyo, the city ranked 2nd in Knight Frank’s Skyscraper Index. Hong Kong’s dramatic lead can be attributed to a variety of factors, such as the restricted geographic area which results in developers having to convert air into land and build upwards.

Asia Pacific – industries to watch

Source: Knight Frank Global Cities 2015 Report, Page 69

Technology and IT sectors have been the key drivers of the take-up of office space in Asia. Financial services and banking, the sectors that led the pre-Global Financial Crisis (GFC) boom, continue to be more cost conscious, and while there is still demand from these sectors, there has been less ‘front’ or ‘prime’ office demand. Over the coming years however, we expect financial services and banking occupiers to come back to drive sizeable segments of demand. Other sectors prominent in the Asian office markets include international law firms and the oil and gas sector.

Real Estate Investment Trends

Source: Knight Frank Global Cities 2015 Report, Page 72

Performance of prime office yields over bonds

An influence on today’s investment market relates to changes in the bond market. Due to the relative sizes of the markets, a small re-allocation away from bonds and towards property can have a significant ‘weight of money’ effect on real estate. Global property investment volume totalled US$559 bn in 2013, whereas the market for issued UK government bonds alone is US$2.3 trn.

1. Re-allocations from Asian insurers and pension funds – focusing on Chinese insurers

Over the next five years and beyond, Asian insurance companies and pension funds are set to play an increasingly important role in the real estate landscape. Looking at volumes invested within Asia-Pacific by these institutions (and sovereign wealth funds), we can see that they have been increasingly active over the past few years.

We can expect Chinese insurers who are now allowed to invest up to 30% of their assets in real estate to become more important purchasers in global cities over the coming years.

2. Investment volumes in 2013 in Asia rebounding to hit 2007 peak

In terms of investment grade product, the most significant liquidity is in the core markets of Japan, South Korea, Singapore and Hong Kong. Japan continues to be the most active market. Overall, in the market for income producing or completed assets, Asia saw increased activity in 2013, with volumes across the region rebounding to hit 2007 levels.

Internationalisation of the investment market

Source: Knight Frank Global Cities 2015 Report, Page 68

A feature of the new real estate landscape is the internationalisation of the investment market. Foreign buyers have accounted for the majority of investment volume in London for seven of the last 10 years. Most of the other Global Cities have seen a notable rise in foreign investment, buoyed by new money from emerging markets. For new comers, buying in core locations is tempting, but that is not necessarily where the best opportunities are.

Emerging markets investors have proved quick to acknowledge this, as shown by Chinese money targeting up-and-coming Brooklyn, as well as the recent purchase by China Construction Bank of 111 Old Broad Street, a central London office building for circa US$187m. We believe the next few years will see more joint venture development between international investors and local property companies.

Another point to consider is the growing importance of airports in shaping real estate investment. Dubai’s growing popularity as aviation hub has supported the city’s rise as a staging post for international real estate investment.

Asia, led by China with the increasing internationalisation of the renminbi

In Asia, two trends can be expected:

1. The increasing inter-connectivity of Asia – led by China

China is now the dominant trading partner of most Asian countries, including being the leading export market for Hong Kong, South Korea, Thailand and Taiwan. Further integration is not restricted to the trade of goods and services; we are also witnessing an increase of cross-border capital flows, again, led by China. The announcement in April of the Hong Kong-Shanghai stock connection – allowing equity trades between the two Chinese financial hubs.

Over the next five years, we expect the increasing internationalisation of the renminbi, which will soon be traded and cleared in London, to extend China’s economic reach even further.

2. More outward looking approach of Asian corporates and investors

Asian corporate occupiers are expected to be increasingly active in global cities around the world, led by banks, financial services and energy sectors. Asia is now an important exporter of capital for real estate and we are seeing more investors and developers look outside their home markets for opportunities.

Looking to the future, the growth in the Asian insurance institutions and pension funds and their increasing exposure to real estate is likely to be one of the key headlines in the real estate investment landscape over the next few years. We can expect more institutional capital in the form of insurance, pension and sovereign wealth coming from China, Indonesia, India and Thailand.

To download the report, please visit: